Interim accident insurance

Those who arrange interim accident insurance receive excellent benefits In the event of an accident for up to six months after compulsory NOA cover ends.

Content

Short and succinct

- Interim accident insurance extends compulsory cover against non-occupational accidents by up to six months.

- Cover for non-occupational accidents is also valid abroad.

- Interim accident insurance must be arranged and paid for before the person’s compulsory non-occupational accident insurance ends.

Close the insurance gap

If you leave your job or take unpaid leave, you remain insured against non-occupational accidents for a further 31 days. Your last day of work is the most recent day for which you were entitled to at least half a day’s pay.

Those receiving unemployment compensation or undergoing integration measures as part of their disability insurance are insured against non-occupational accidents in accordance with the Federal Accident Insurance Act (AIA). They are also eligible to take out interim accident insurance within the first 31 days after their entitlement ends.

Their accident cover expires after 31 days – which can become expensive. Close this gap with interim accident insurance and enjoy up to six months of additional cover.

Arranging or extending interim accident insurance

Take out your interim accident insurance conveniently online.

If you have any questions or require support, your Suva agency will be happy to help.

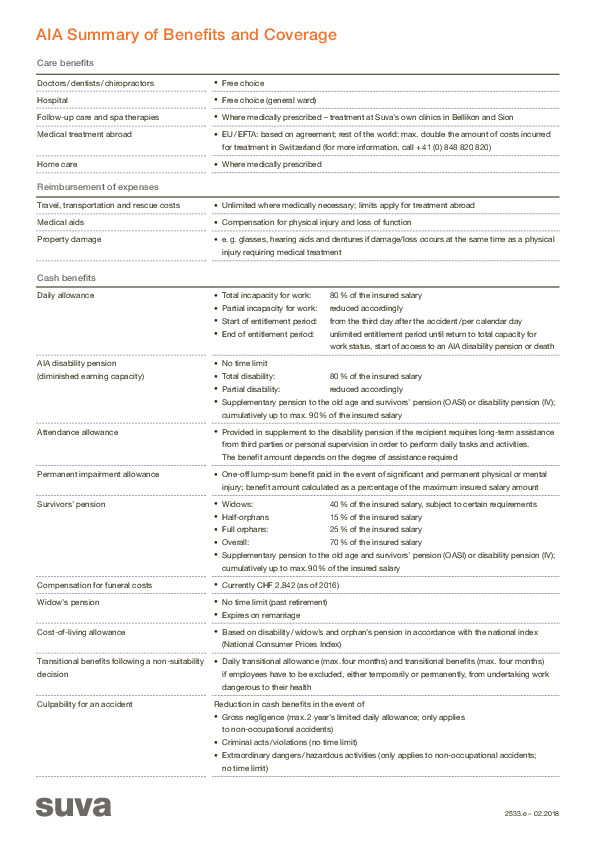

What benefits do we provide?

Insurance benefits are provided in accordance with the provisions of the AIA. Suva’s interim accident insurance provides numerous benefits such as medical treatment, rescue and recovery operations and medically necessary transportation. Unlike with health insurance, policyholders do not have to contribute to the costs – deductibles and excesses do not apply – and can still claim daily allowances or pensions.

There is no entitlement to daily benefits if an accident occurs after retirement (withdrawal from the labour market).

Extending your accident insurance

Interim accident insurance enables you to extend your compulsory non-occupational accident insurance cover. Anyone who arranges interim accident insurance with their previous insurer before the one-month additional coverage period expires can extend their cover for non-occupational accidents by up to six further months.

Interim accident insurance also automatically pauses during military service or civil defence service, extending afterwards by the length of deployment.

Who is eligible to take out interim accident insurance?

You can take out interim accident insurance policy with Suva if you have worked for a Suva-insured company for at least eight hours a week, had been entitled to unemployment compensation or had undergone integration measures as part of your disability insurance.

Attention!

Interim accident insurance with Suva has to be taken out within 31 days of the last day for which you were entitled to at least half a day’s pay in order to ensure seamless cover.

If you do not arrange interim accident insurance within these 31 days (referred to as the additional coverage period), you will no longer be able to take out cover. The consequent expiry of non-occupational accident insurance cover could prove costly.

Missing the deadline can mean that the risk of accidents is only covered by compulsory health insurance. This means that the person concerned will not benefit from the conditions of non-occupational accident insurance in accordance with the Federal Act on Accident Insurance, as is guaranteed with interim accident insurance.

How much does it cost?

A monthly premium costs 65 francs (to be paid online by credit card, debit card, PostCard, Twint, or PayPal). Once payment is made, you will receive an internationally recognised insurance certificate.

The 31-day deadline for arranging cover also applies for payment of the premium (CHF 65.– per month). The total for a six month period is CHF 390.–.

Please note that once interim accident insurance has been arranged, it cannot be cancelled. It is also not possible to refund the premium cost. It is therefore worthwhile to only take out interim accident insurance for the period for which it is definitely required (minimum period: one month). If needed, cover can be extended for a maximum of six consecutive months.

Insured worldwide

Anyone who is insured against non-occupational accidents also enjoys Suva insurance cover abroad. This cover provides numerous benefits such as medical treatment, rescue and recovery operations and medically necessary transportation.

The full scope of cover is detailed in the following brochure.

Insurance conditions

Interim accident insurance must be arranged and paid for before your compulsory non-occupational accident insurance expires. Before extending your cover against non-occupational accidents, you should take note of the following.

- Interim accident insurance cannot be cancelled. It is also not possible to refund the premium cost. Therefore, please only arrange interim accident insurance for the period for which it is definitely required (minimum period: one month). If needed, your existing interim accident insurance can be extended for a maximum of six months.

- If you need to extend your cover beyond six months, it is worth adding accident cover to your health insurance policy.

- Interim accident insurance is only intended for non-occupational accidents and therefore does not cover occupational accident risks.

- Those who are unemployed and thus entitled to claim unemployment compensation are insured against accidents by Suva.

- Insurance cover for those carrying out military service, alternative service or civil defence service is provided through military insurance.

- Military insurance cannot be extended via interim accident insurance. Any additional coverage period or interim accident insurance already in place will pause during military service, alternative civil service or civil defence service.

- Insurance cover is only valid provided the declarations that you make are correct.